Don’t worry; we will keep this simple! Let’s get started:

Do I Have To Choose A Business Entity?

Choosing to be an LLC or a corporation comes with certain perks and brings protections when it comes to business debts (such as being able to separate your personal finances from the debts of your company). But with that being said, you can create a business without your company falling under the label of a formal business entity.

That means:

If you’re flying solo, you’ll hold the position of a sole proprietor. If you’re working with business partners, you’ll be part of a general partnership. You can always form a formal business entity later on once your business concept takes off.

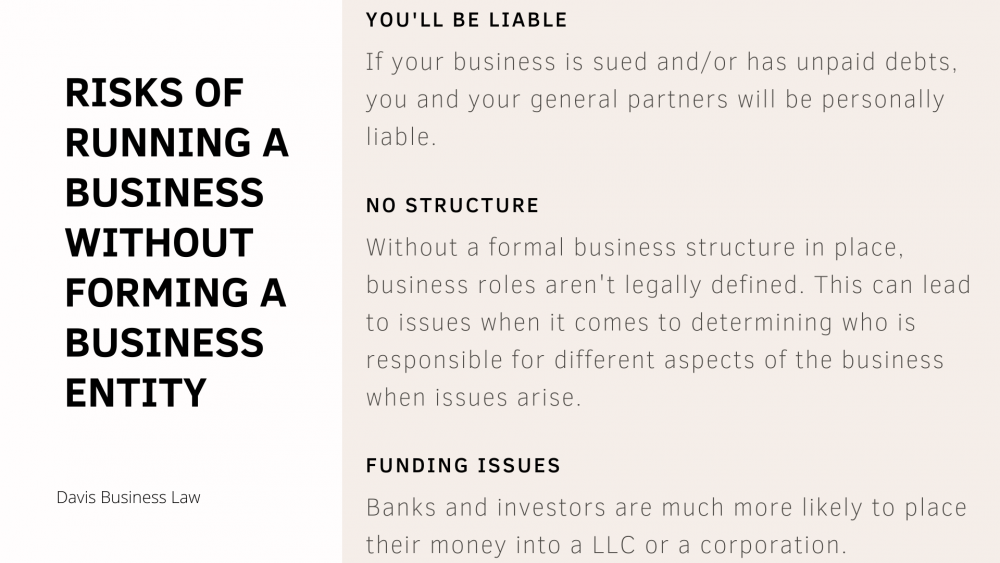

But risks can arise:

What Is The Difference Between An LLC and a Corporation?

A lot of people often wonder what the differences between an LLC or a corporation are or if it even matters which route you choose. Let’s dissect each one.

What Is An LLC?

An LLC stands for Limited Liability Company. LLC owners are known as “members” and every member owns a percentage of the company. When it comes down to management, the majority of LLC’s are managed by their members, but they can also be run by a group of managers. This is mainly done when there are members that are completely hands-off in decision making and day to day operations.

Forming an LLC

When it comes to forming an LLC, you and the other members (if there are any) will file what is called the Articles of Organization.

An Article of Organization is a document filed with the secretary of state laying out the concept of business and basic details of your company. After filing the Articles of Organization, you will then put together what is known as an Operating Agreement. This agreement is used to manage the day to day operations and holds each member accountable to their respective duties.

What is a Corporation?

Corporations, also known as C Corporations, are legal entities that provide the highest amount of protection to business owners. This type of business formation is great for medium to high-risk business ventures.

Forming a Corporation

The creation of your corporation will begin with filing the Articles of Incorporation (a government document simply stating the existence of your corporation) in the state in which your corporation resides. You will then create a Board of Directors to monitor your corporation from the top down. In addition to overseeing your corporation, your Board of Directors will also set your company’s bylaws.

The Types of Corporations

S Corporations

S Corporations allow your corporation to function as a C Corporation but maintain the tax benefits of an LLC.

B Corporations

B Corporations are perfect for a business that wants to put an equal amount of focus on society, the environment, and their profits. This type of corporation is unique due to the fact that other forms of corporations can be taken to court by their investors if profits are not put before all else.

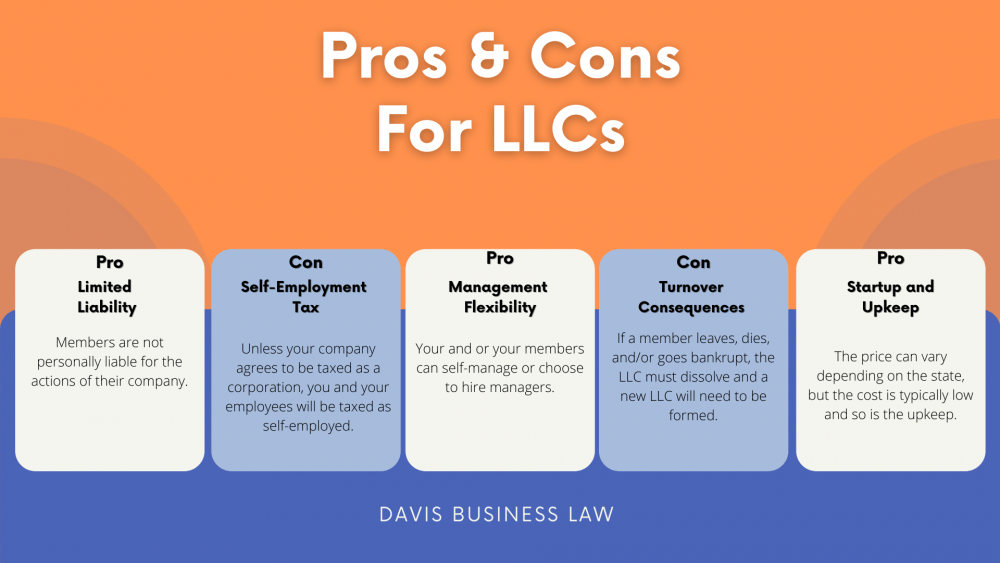

What are the Pros & Cons of LLCs?

Pros:

- Members are not personally liable for the actions of their company.

- Your and your members can self-manage or choose to hire managers.

- The price can vary depending on the state, but the cost is typically low and so is the upkeep.

Cons:

- Unless your company agrees to be taxed as a corporation, you and your employees will be taxed as self-employed.

- If a member leaves, dies, and/or goes bankrupt, the LLC must dissolve and a new LLC will need to be formed.

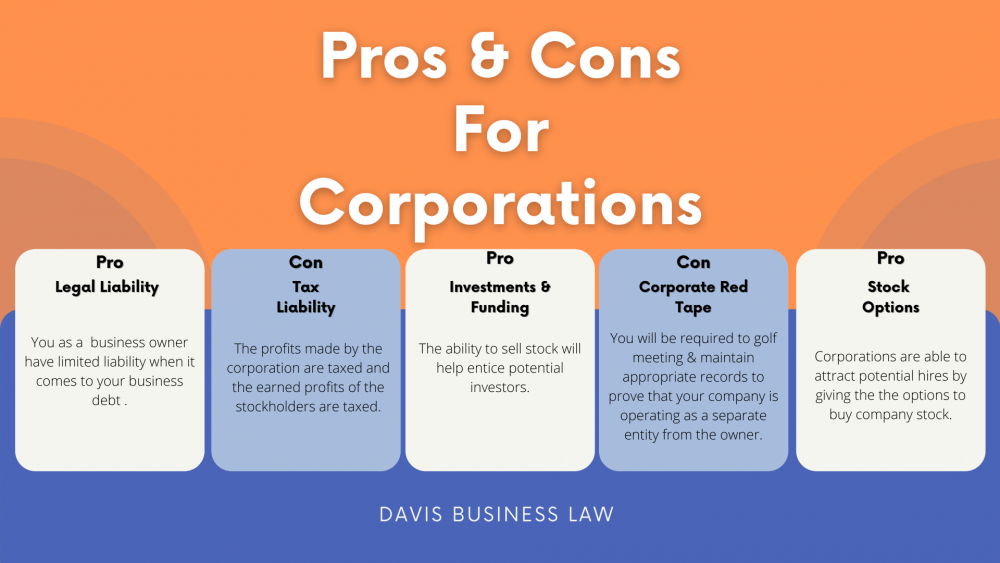

What Are The Pros & Cons of Corporations?

Pros:

- You as a business owner have limited liability when it comes to your business debt.

- The ability to sell stock will help entice potential investors.

- Corporations are able to attract potential hires by giving them the option to buy company stock.

Cons:

- The profits made by the corporation and the earned profits of the stockholders are taxed.

- You will be required to go to meetings and maintain appropriate records to prove that your company is operating as a separate entity from the owner.

Don’t Wait Let Us Help

At Davis Business Law it doesn’t matter if you choose an LLC or a corporation; our business attorneys can help you get your business running. We have the track record and the passion to provide you with the best legal services your business needs. To get started or to learn more you can contact us online! Let us worry about the what-ifs so that you can focus on what matters: your business.

Matthew Davis

Business Lawyer/CEO

The content on this page has been reviewed and approved by Matthew Davis: CEO of Davis Business Law.

Meet Our Dallas Business Lawyers

Charles Penot, Esq.

Kevin McGraw, Esq.

William Neubauer, Esq.

Meet Our Fort Worth Business Lawyers

Kevin McGraw, Esq.

Charles Penot, Esq.

Jonathan Ashton, Esq.

Meet Our Austin Business Lawyers

Jonathan Ashton, Esq.

Charles Penot, Esq.

Kevin McGraw, Esq.

DAVIS BUSINESS LAW AUSTIN, TX

6500 River Place Blvd, Building 7 Suite 250

Austin, TX 78730

Meet Our Denver Business Lawyers

Justin Williams, Esq.

Jeffrey Graham, Esq.

Matthew Davis

DAVIS BUSINESS LAW DENVER

4045 Pecos Street, Suite 210-11

Denver, CO 80211

Tel: (720) 833-4928

Meet Our Wichita Business Lawyers

Sean Durr, Esq.

Jason Janoski, Esq.

Jeremy Arens, Esq.

Meet Our Overland Park Business Lawyers

Tim Pullin, Esq.

Jeremy Arens, Esq.

Sean Durr, Esq.

DAVIS BUSINESS LAW OVERLAND PARK

Meet Our Enid Business Lawyers

Matthew Davis, Esq.

Lexy Vela, Esq.

Dixie Watkins, Esq.

DAVIS BUSINESS LAW ENID, OK

525 W. Maine St.

Enid, OK 73701

Tel: (580) 237-5820

Meet Our Edmond Business Lawyers

Paige Oku, Esq.

Noelle Moorad, Esq.

Lexy Vela, Esq.

DAVIS BUSINESS LAW EDMOND

Meet Our OKC Business Lawyers

Jeffrey Graham, Esq.

Lexy Vela, Esq.

Noelle Moorad, Esq.

Paige Oku, Esq.

Dixie Watkins, Esq.

Jeff Cummings, Esq.

DAVIS BUSINESS LAW OKLAHOMA CITY

Meet Our Tulsa Business Lawyers

Ryan Harper, Esq.

Heather Cupp, Esq.

Noelle Moorad, Esq.

Meet Our Yukon Business Lawyers

Dixie Watkins, Esq.

Jeffrey Graham, Esq.